Account-based marketing at SAP

Automation of Account-Based Marketing at SAP began in 1997 under the leadership of Albert Denz, then VP of global marketing. Albert asked me, as an add-on project, to provide marketing reports to support decision-making at quarterly Sales & Marketing meetings. It was the start of an innovative five-year project …

Initially, I supported account-based marketing with a standard “Key Accounts Report Book”. It was simple but comprehensive, showing views of sales volume and value by key account, and could be summarised by geography, industry sector, or product. Colleagues in marketing and sales gave feedback on the initial contents. I suggested improvements and standardised chart formats and layouts. By minimising the production effort, I reduced the cycle time, which improved the recency. That increased the value for decision support. After a couple of cycles, I got the production time down to about one day per quarter. But I still had a feeling that something important was missing.

Shifting the Perspective for better ABM

That feeling nagged at me – until the day the Sales manager for Japan, who was visiting the head office, met with Albert. (I wish I could remember his name and give credit where it is due.) He brought an article from a Japanese business magazine that listed the Top 10 companies for each of four major industry sectors, ranked by revenue. He had highlighted each company name in traffic light colours. Green for “is already a customer”; yellow for “Sales are in discussion”; and red meaning “not yet targetted”. So simple; so effective. This was the significant difference that I had been looking for.

Albert handed me a copy of the report. I took one look and said “brilliant”. Albert nodded and asked how I planned to use this idea. “Fortune Global 100 list,” I suggested. “Sounds good,” he said – and let me get on with it.

The advantage of being on the outside, looking in

This concept was powerful because it showed an external view of the market and SAP’s place within it. By contrast, internal reports could only ever show SAP’s limited and incomplete view of the market. But by using this new style of report, managers could do much more than simply monitor sales progress. They could identify future potential, use it to actively plan ahead and prioritise the use of resources.

It delivered value because it exactly matched SAP’s account-based marketing and sales strategy at that time. Sales would actively identify leading organisations and set out to win their business. The Top 100 list provided both a yardstick for success and a structure for action. Indeed, the typical sales pattern at that time was immediately visible in the Report book. A timeline of software revenue by quarter for a Key Account typically showed a three-step pattern: a small contract win of about DM 100.000; then nothing significant for 18 months while the pilot project was run at a single location; followed by a massive, global, multi-year contract. The 1996 win at Coca-Coa, for example, set a new record for multi-year global contracts at around DM 40 million.

The Global 100

Implementation was labour-intensive. I had to had to manually copy the Fortune Global 100 list into Excel. Each company had to be classified by industry and country of head office, as well as by size categories for revenue and number of employees. Then came the task of manually searching for each company within the internal data systems, extracting the sales history and mapping it to the Excel sheet. The first version of what we called the “Global 100 Report” took the Excel list and used a pivot table to provide national views for each country Sales manager.

Reactions to the “Global 100” were mixed. The concept was great for management at global level. Good for global industry marketers, too: they could identify major clients and future potential globally. For country office use, however, the data view was too narrow. Where the original Japanese magazine article showed 40 companies, the Japan country extract from the Global 100 held less than 30 organisations. Many of the Fortune 100 had head offices in the US – and at that time, SAP did not have a major presence there. Conversely, the country lists for Germany, France and the UK were, like the one for Japan, too thinly populated.

The Global 500

The obvious solution was to ramp up the scope – by a factor of five. The basis for the third iteration of the Global Market Report was the Fortune Global 500. To handle this level of activity, I focussed heavily on making the process steps simple and repeatable. A master table mapped the company names used by Fortune against the Account IDs used within SAP’s internal systems. And as the tables themselves began to hold multiple dimensions of data, the project switched from a single Excel sheet, to multiple tables held in Access, with data relationships documented by star diagrams.

It was at this stage that the differences between computer systems and the real world became a very tangible issue. Those differences showed up in several areas. What SAP’s internal systems called an Account was often a single location of a real-world business. How do you map the ownership of multiple subsidiaries of an organisation in the internal system, so that revenues or product sales can be rolled up into Key Account totals – or drill down from a global total to provide a national view? The SAP system does indeed provide a solution for this, called hierarchy nodes. Nevertheless, the issue was Master Data management: the completeness and accuracy of internal records. Data quality became a hot button for Key Accounts and for effective account-based marketing.

The Global Market Database

Another issue was how to source classification data. When the scope doubled again (the 4th iteration) the ABM Report became the Global Market Database. But classifying the Top 1.000 Organisations into size bands by revenue or the number of employees became an issue. It was easy to find out that a company like, say Shell, employed about 100.000 people worldwide. But SAP wanted to sell software licences by country, so marketing and sales wanted to know how the employee total broke down by country. Where was that data to come from? I learned that Hoppenstedt could provide data that covered German companies – but what about the rest of the world? And that’s how I came into contact with the team at Dun & Bradstreet’s Frankfurt office. And with Mel Baruch, my primary contact for discussions on D&B data structures and quality.

Integrating Dun & Bradstreet data

The 1784 Dataset is Dun & Bradstreet’s proprietary data format. It’s a company record for tracking key data about individual business locations and their position in corporate family trees. Data about subsidiaries could be rolled up into national businesses, and combined into international organisations. This meant we could solve two problems at the same time – sourcing the classification data AND getting an external validation on the who-owns-who that was essential for Key Account management in internal systems.

I prepared a business case for purchasing the D&B data. This was approved and the data was delivered on CD. The next step was to work with IT and get new placeholders added to the Customer Master Data records. This method allowed us to use the unique Duns Number which identified each 1784 Dataset, and perform a batch upload to enrich the customer data.

In practice matching the Master Data record IDs in SAP’s systems to the D&B Number revealed multiple problems with internal data quality: duplicate records, inaccuracies, incompleteness, variations in naming and spelling. The IT team created a tool in-house, that achieved 80% matching on the first pass; the remaining 20% had to be manually checked and verified. This phase was a classic lesson in the importance, cost and value of data quality. Once completed however, the matching ensured the smooth, fast integration of fresh data. But we also learned that data quality has to be addressed as an ongoing process, too.

Going for gold – 1.000.000 company records

At this time, Data Warehouse was a big news item in the software market. The relative merits of (now everyday) techniques like OLAP, ROLAP and MOLAP were discussed in enormous depth in the computer and business press. Meantime, SAP was itself rolling out a CRM solution and developing a slice-and-dice reporting interface. Later (2007) it would acquire Business Objects and integrate its technology into SAP. Close collaboration with IT colleagues on the internal CRM project became part of my daily work, translating marketing requirements to IT change requests and designing the functionality of roll-up and drill-down user interfaces.

Meantime, the business focus of the Global Market Database was squarely on ABM for Key Accounts, and supporting sales as SAP deepened its successful penetration of the top-tier organisations. To do that we had to know who owned what – in detail. A global company of the scale of Siemens, for example, could have 1.000 subsidiaries. So we had to be selective and bought the significant D&B records that allowed us to understand the company structure, and get an accurate picture of how best to serve those customers. But we were looking ahead, too. With the 5th iteration of GMD, we acquired data to identify the major players in the Upper Mid-Size and the Lower-Mid-Size segments.

By this stage, technical integration of the D&B data with internal systems had become a matter of routine. It was around this time that we signed a three-year contract with D&B for quarterly updates of 1 million company records. The data was delivered by recorded delivery on CD, and taken straight to IT for upload into internal systems. Next day, the new data surfaced in the GMD reports.

ABM and Selling to the Mid-Market

As SAP’s penetration of the Top Tier approached saturation, the transition to the Mid-Market involved significant shifts in the economics of doing business, which translated into massive changes for both account-based marketing and Sales.

When it was going after the Top Tier, small tightly-focussed Key Account teams were the ideal way to guide Prospects through the sales stages of education, agreement to run a Proof of Concept project, then close with a company-wide strategic deal. That deal often took the form of a Value Contract – a carte blanche right to implement selected components of the ERP suite, in any subsidiary or location the client organisation chose. Expressed in terms of price per seat, the value contract represented huge savings over the list price.

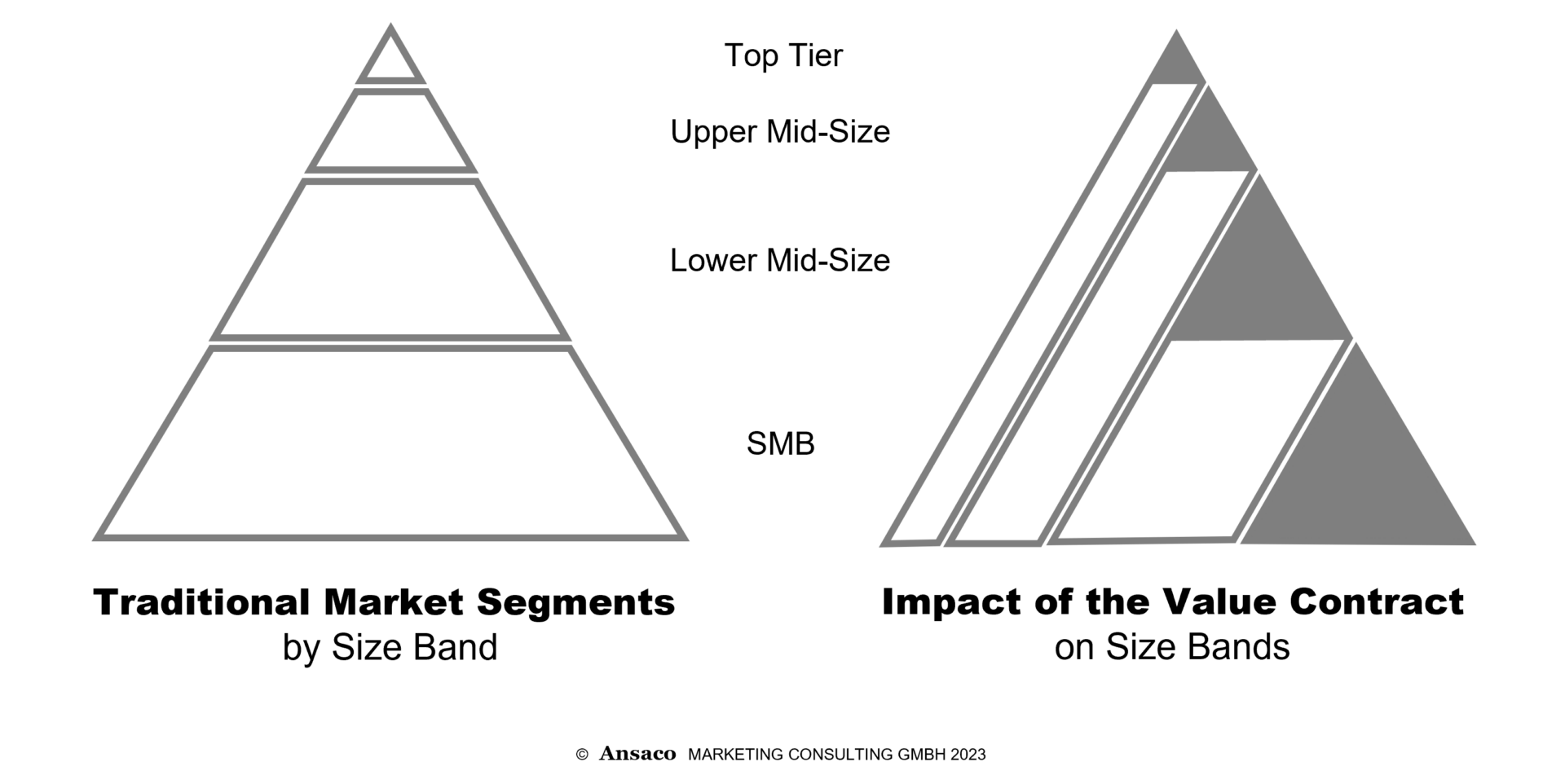

But the Value Contract did much more than simply deliver value for the customer – it tipped the traditional market segment diagram on its side. By closing a multi-year, international deal with the head offices, the Value Contract effectively ring-fenced the entire organisation globally. In practice, the scope of an “SAP Customer” embraced not just the IT strategy at head office (or its global IT nerve centre), but included ERP Practice in operating divisions (frequently classifiable as Upper Mid-Size), national sales territories (Lower Mid-Size), all the way down to local subsidiaries (at SMB scale). Once the client had defined its IT strategy as “for ERP, we choose SAP” the speed of roll-out was simply a matter of time and resources, and the timetable defined by the customer’s management team.

The impact on the Account-Based Marketing strategy

Following the traditional market segmentation by size bands means that each progression from top downward means a greater number of contracts of lower average value. For each prospect there are the same process stages of: identifying, prospecting, nurturing, qualifying and closing. But both Marketing and Sales have to find different ways to reach those people and “win hearts and minds” at a progressively lower price point. Different positioning, messages, media, events, styles and scales of interaction. It’s quite literally, a whole new Go-to-Market strategy at each level.

In this context, the Global Market Database provided clarity and focus for account-based marketing by making corporate family tree structures visible. It showed national Sales teams which businesses were already covered by a global Value Contract – and which were genuinely new territory. At each stage, Sales could focus on selling to the “leading edge” of the market. These are the dark triangles in the right-hand diagram, and represent the high priority targets – the head offices of independent businesses that make their own choices – within each size band.

Global roll-out

As both the scope of the contents and the costs for the Global Market Database increased, so it also made sense to roll-out access to provide account-based marketing for a wider group of users. An important component of this was a corresponding authorisation plan, which was implemented by IT via ID and password systems. Board members and a handful of senior management with global responsibilities, of course saw all data dimesions at all levels of granularity: geographic regions, industries, products and Key Accounts.

Beyond that user group, access was restricted by role. Within global marketing, individual industry marketers had a global view of their industry. Key Account sales teams had a global view of all industry, product and country data for their account. Product marketers had a similar global view for their product only. Regional directors, with responsibility for multiple countries (EMEA, Americas, APAC) saw all the countries within their region. Country managers saw all industries within their country …and so it went on, down to country marketers specialising in two or three industries. By 2002-2003 there were over 1.250 users worldwide.

Even good things must come to an end

A change of finance director brought a new attitude to the availability and sight of revenue data. Initially, finance wanted to prevent marketing from seeing revenue data at all. Fortunately, common sense prevailed, and marketers were allowed to see the financial impact of their campaigns. Then came an additional question about SAP’s status as a publicly-listed company – and so SAP’s own software revenue data for the current quarter was hidden to those outside the boardroom; that data was only released after the Quarterly results had been published. An understandable decision, perhaps, but I wondered at the time whether that delay reduced the perception of value for decisions at national level.

Shortly after that, finance took the project over from marketing. Bain sent a junior consultant who told me that they had been invited to implement a “share of wallet” project, and to ask if marketing could help. He was surprised to hear that marketing had been delivering exactly that for the previous five years. After that I heard no more.

The fact remains, the “Global Market Database” was a brilliant account-based marketing project: it provided enormous scope for innovation and delivered solid commercial value. On a personal level, it demanded both creative problem-solving and process improvement at every stage of evolution. It involved steep learning curves for both business and technology issues, and brought me into contact with great people within and outside marketing – in management, business development, Sales, IT, CRM development, purchasing, contracts, as well as at D&B. All in all, the SAP “Global Market Database” was an enormously satisfying phase in my professional life.